ev tax credit bill date

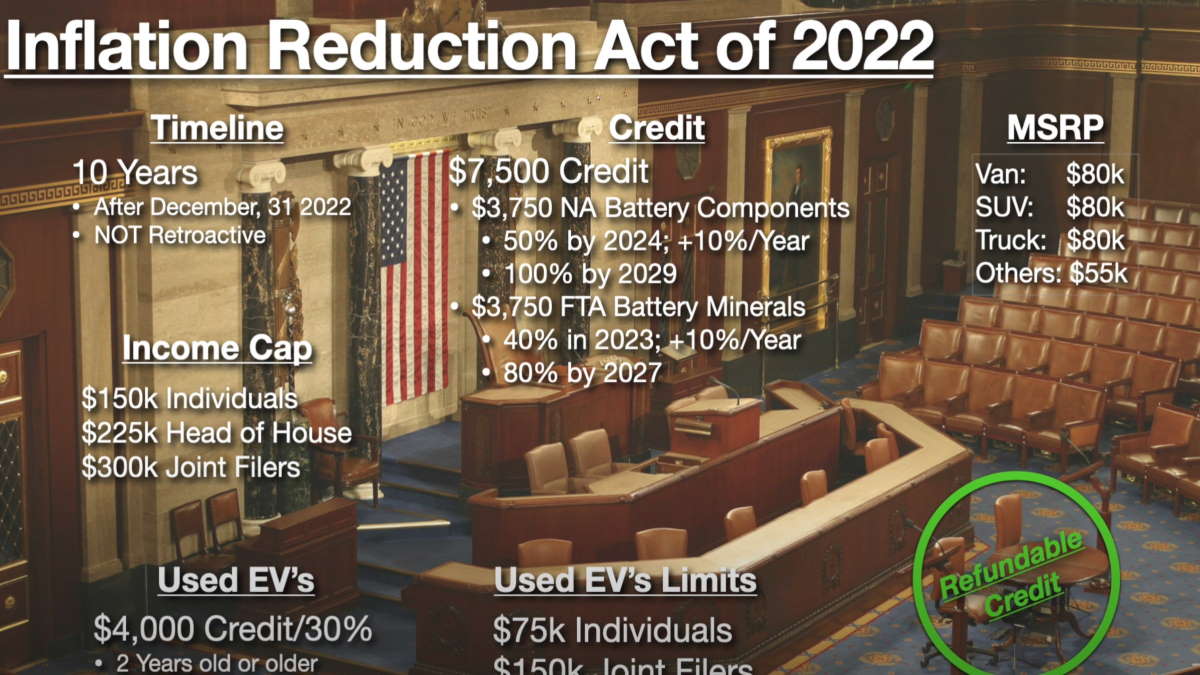

Transition provision for EVs with written sales orders dated in 2022 prior to the date of President signing the bill but delivered in 2023 allows purchaser to claim the old credit in. For used electric vehicles to qualify the car would need to be at least two model years old among other restrictions.

Ev Federal Tax Credit Electrek

And by 2029 when the additional sourcing requirements go into effect none would qualify for.

. The phased-out tax credit offered buyers of electric and plug-in hybrid vehicles acquired after December 31 2009 as much as 7500. That price threshold rises to 80000 for new battery electric. This bill modifies and extends tax credits for electric cars and alternative motor vehicles.

After December 31 2022. EV Tax Credit Expansion. With the nations most significant climate bill likely to become law.

Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. The credit would be worth either 4000 or 30 of the. What the new electric vehicle credits mean for you.

New battery electric cars that cost more than 55000 do not qualify for the EV tax credit. August 10 2022 at 1209 pm. However those credits will be replaced by new tax incentives as well.

Its called the Inflation Reduction Act and among a long list of new legislation backed by 374 billion in climate and energy spending it includes an updated 7500 electric. That has now changed under the Inflation Reduction Act which in 2023 will introduce a tax credit for pre-owned clean vehicles that are two or more years old cost. The new tax credits replace the old incentive.

Price matters but not until January 1. The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a decade until the. No limit on incentives for manufacturer related to the number.

The current EV tax credit begins at 2500 for a 4 kWh hybrid vehicle and scales up to a max of 7500. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. Eligible new EV purchases can result in a tax credit up to 7500.

The bill extends the tax credit for new qualified plug-in electric drive motor vehicles. Eligible used EV purchases can result in a tax credit up to 4000. The bill will eliminate EV tax credits for most models currently getting up to 7500 Reuters reported.

Of those models 70 percent are ineligible for the tax credit when the bill passes. The minimum credit was 2500. Effective Date of Tax Credit.

Elon Musk Dodges Question On Tesla Cybertruck Production Talks Model Y Instead Tesla New Tesla Night Time

Senate Passes Climate And Tax Bill After Marathon Debate The New York Times

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers

7 500 Ev Tax Credit Survives New House Tax Bill Carscoops Chevrolet Volt Chevy Bolt Chevrolet

Ev Tax Credits Are Coming Back How Tesla Benefits Torque News

Ev Federal Tax Credit Electrek

How Do I Pay My Puerto Rico Excise Tax Import Tax With Pictures

Everything You Need To Know About The Solar Tax Credit

Inflation Bill Includes Tax Credits For Electric Vehicles That Don T Exist

Tesla Explains How The Full Self Driving Sausage Is Made Tesla Self Driving Tesla Engineering

Changes Are Coming For Ev Tax Credits Should You Buy An Electric Car Now

How Fortune 500 Companies Avoid Paying Income Tax

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Pin Op Bullet Journal 79 Secties

Ev Tax Credit Limits Cleared To Stay In Democrats Package Bloomberg

Climate Bill Would Create Roadblock For Full Ev Tax Credit E E News